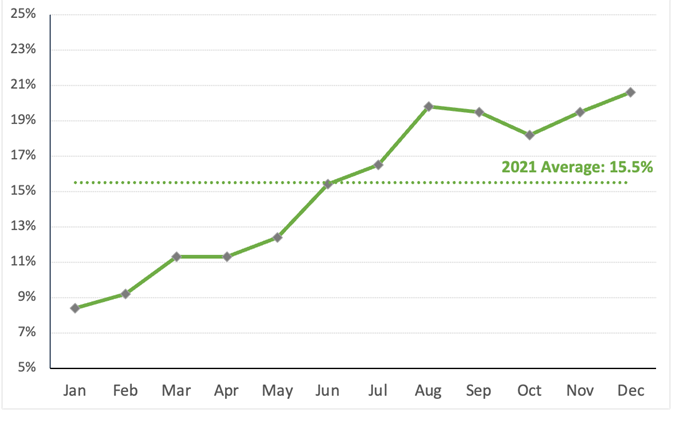

2021 witnessed significant growth in electric vehicle (EV) sales in China. The share of new energy vehicles in new passenger vehicle sales more than doubled from 8.4% at the beginning of the year to 20.6% by year’s end (see Figure 1). This EV sales surge was driven by both policy incentives and growing consumer demand.

Figure 1: 2021 shares of new energy vehicles in new passenger vehicle sales in China

In 2021 and 2022, China continued to provide subsidies and tax benefits for EV buyers, making lower emission vehicles more cost competitive. Meanwhile, China continues to tighten its dual credit policy annually, which requires manufacturers to produce a certain percentage of EVs every year. In addition, government investment into charging infrastructure, parking and license plate privileges, and supply chain incentives all drove this explosion of EV adoption in China.

However, national and subnational policies only account for part of the story. More EVs are being sold because consumers want them. For example, the best-selling EV model in China, Wuling Hongguang Mini, only enjoys a small fraction of policy benefits because of its short driving range (most of China’s EV incentives are tied to the technical performance of vehicles, including range). Therefore, improvements in product quality, greater model availability, as well as drivers’ rising level of confidence with EVs also contributed to the booming market.

Given that China is expected to achieve its 20% EV sales target for 2025 ahead of time, it’s worth asking what comes next? Decarbonizing the transport sector will require much more than electrifying passenger vehicles. So as China seeks to fulfill its carbon peaking and neutrality pledges, it should also focus on other transportation decarbonization approaches, including the following opportunities:

First, leverage different transport decarbonization strategies. China’s 15.5% 2021 average of EV share only includes passenger cars, which are easier to electrify than the heavy transport sector. To electrify buses and trucks, China can draw from its successful passenger car policies, such as subsidies and sales requirements. The heavy-duty sector also needs policy innovations to tackle unique operational, cost and infrastructure challenges. In addition, aviation and shipping both contribute to significant transport emissions and currently lack concrete decarbonization pathways. Even within the passenger vehicle sector itself, electrification isn’t the only solution in the upcoming decades. Policies to improve the fuel efficiency of conventional vehicles and encourage mode shift are also crucial because of the large existing market of gasoline and diesel cars.

Second, decarbonize the whole life cycle of EVs. Most EV policies in China don't include emissions from power generation, raw materials extraction, steel production, and battery disposal. Battery and electricity demand will grow dramatically as EV share keeps rising, which calls for more regulations on the production and end-use of EVs and their components. Instead of treating all EVs as zero-emission cars, future policies should differentiate EVs based on life-cycle emissions and efficiency. China has just started to issue battery reuse and recycling policies to regulate the second-life use of batteries and control associated safety risks – a step in the right direction.

Finally, design new policies to accelerate the transition. China’s decade-long subsidy program has been the strongest incentive to grow the EV market in early years. As the market takes off and the subsidy policy is phased out in 2023, China needs innovative EV policies that tackle new challenges. Examples include zero-emission zones, battery swapping standards, vehicle-to-grid integration regulations, and R&D support to further improve battery performance. China included vehicle-to-grid applications in its long-term EV plan and started its first batch of battery swapping pilots in 2021. More detailed policies on these emerging technologies are needed in the upcoming years to lower EV costs, reduce burden on the grid, and shorten charging time.

China has shown great progress in the shift to passenger EVs through a combination of policy incentives and consumer demand, but there’s much more work ahead. What comes next will help determine how quickly and efficiently the world can reduce emissions.